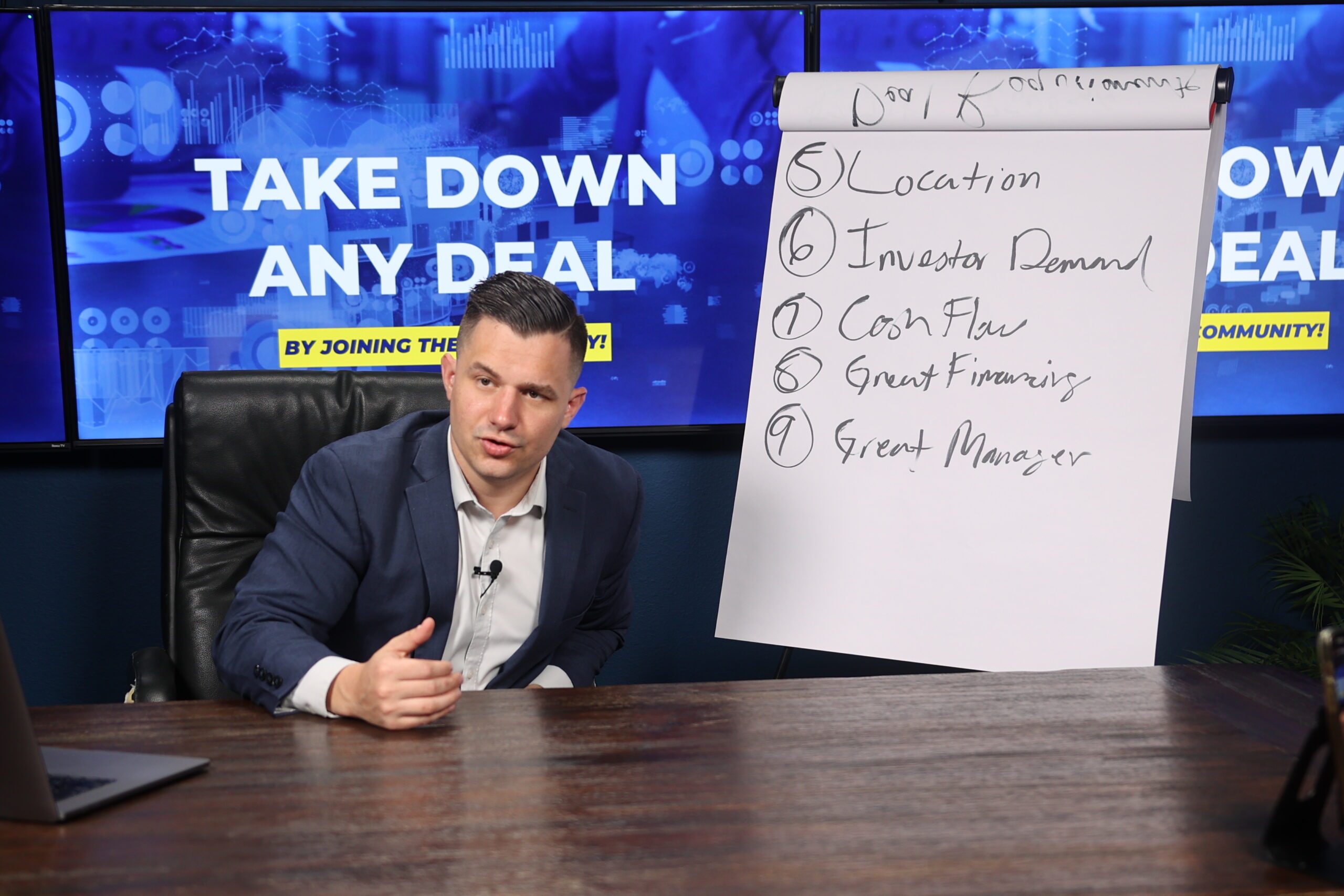

Table of Contents

- Opportunity: Spotting the Potential in Commercial Real Estate

- Value: Unearthing the Real Worth of Your Investment

- Equity: Building Your Stake in the Market

- Multiple Exits: Strategizing for Exit Scenarios

- Location: The Locus of Profitability

- Investor Demand: Understanding Market Needs

- Great Cash-flow: Ensuring Consistent Returns

- Great Financing: Leveraging Loans to Your Advantage

- Great Management: The Bedrock of Commercial Real Estate Success

- Conclusion

Investing in commercial real estate can be one of the smartest financial decisions you make – if you play your cards right. It’s a venture that promises potential for substantial returns, but also carries inherent risks that can’t be overlooked. In this blog post, we will shed light on 10 deal requirements that every investor should meticulously consider before jumping into the realm of commercial real estate investing.

Opportunity: Spotting the Potential in Commercial Real Estate

One of the key allurements of commercial real estate is the opportunity it presents. Smart investors have a keen eye for properties that offer solid growth potential. Environmental changes, infrastructure development, and demographic shifts can turn an average property into a hotbed for high returns.

Value: Unearthing the Real Worth of Your Investment

The true value of commercial real estate goes beyond the price tag. It encompasses the intrinsic worth of the property considering its condition, location, and income generation capabilities. Understanding how to appraise property value accurately is an indispensable part of investing.

Equity: Building Your Stake in the Market

The equity in a commercial real estate investment refers to the difference between the property’s current market value and the amount owed on its mortgage. Building equity is crucial as it increases your leverage and the ability to invest in more properties or improve existing ones.

Multiple Exits: Strategizing for Exit Scenarios

Having a clear exit strategy — or better yet, multiple exit strategies — is imperative in commercial real estate. Whether you plan to sell, lease, or refinance, being prepared for all scenarios ensures you can adapt to market conditions and investment outcomes.

Location: The Locus of Profitability

Location is the linchpin of real estate success. The adage “location, location, location” holds true, especially in commercial investing. An excellent location can spell the difference between a high-performing asset and one that flounders.

Investor Demand: Understanding Market Needs

Commercial real estate’s appeal is heavily influenced by investor demand. Recognizing what investors are looking for – be it offices, retail spaces, or multifamily properties – empowers you to key into markets with higher demand and thus, higher returns.

Great Cash-flow: Ensuring Consistent Returns

Cash flow is the oxygen of real estate investing. A property must generate enough revenue to cover expenses, debts, and still produce a profit. Identifying properties that offer great cash flow potential is essential for long-term financial health.

Great Financing: Leveraging Loans to Your Advantage

Great financing can accelerate your investment success. Low-interest rates, favorable terms, and a good relationship with lenders can significantly enhance profitability. Being savvy about financing is a non-negotiable aspect of real estate investing.

Great Management: The Bedrock of Commercial Real Estate Success

Finally, even the most promising commercial property requires great management. From handling day-to-day operations to strategic planning for the property’s future, skilled property management helps in preserving and increasing a property’s value.

Conclusion

Commercial real estate investing can seem daunting, but armed with the right knowledge of deal requirements, it can become a fruitful venture. Consider these ten requirements sacred and give them the due diligence they deserve. Opportunity, value, equity, multiple exits, location, investor demand, cash-flow, financing, and management are not just buzzwords – they are the bedrock upon which successful commercial real estate investing is built.

By mastering these elements, you’re not just investing in properties; you’re cultivating a mindset and approach that will guide you through the volatile yet rewarding world of commercial real estate.

To thrive within the realm of commercial real estate, generating sufficient revenue to not only cover all expenses and liabilities but also ensure a profit is crucial. Key to this is the identification of properties that present significant opportunities for a strong cash flow, a pillar of financial stability over time.

Don’t forget to follow us on social media for regular updates and insights:

- Instagram: @realalexcoffman

- Facebook: Real Alex Coffman

- TikTok: @realalexcoffman

- YouTube