Table of Contents

An approach to making money that is becoming more and more common is buying land as an investment. There are many ways to invest in land by purchasing it, so there are also equally as many ways to make money off of the land.

There are several factors that everyone who is planning on making an investment purchase on land should know. In this article, we will review some of the crucial points that can help you make the most of your money while making educated purchases of land.

There are a variety of different things that a person can do with a piece of land, and generally, it is up to them. Many people buy land to turn it into a prosperous investment property, which is one of the most common reasons that people buy land.

It is important to understand all of the aspects that go into planning to invest in property and land. Without understanding all of the various factors of investment purchasing, a person can end up losing money on a property. To avoid that, it is important that the buyer does all the research necessary to fully understand the property market and takes the time to investigate different types of property.

An investment property is supposed to turn a profit for the person buying the land, so losing money has a very detrimental effect on the cyclical nature of investment land. Now let’s get into the article and explore some of the important concepts to consider if you are planning on investing in property in the real estate market.

Things You Need To Keep In Mind When Investing In Land

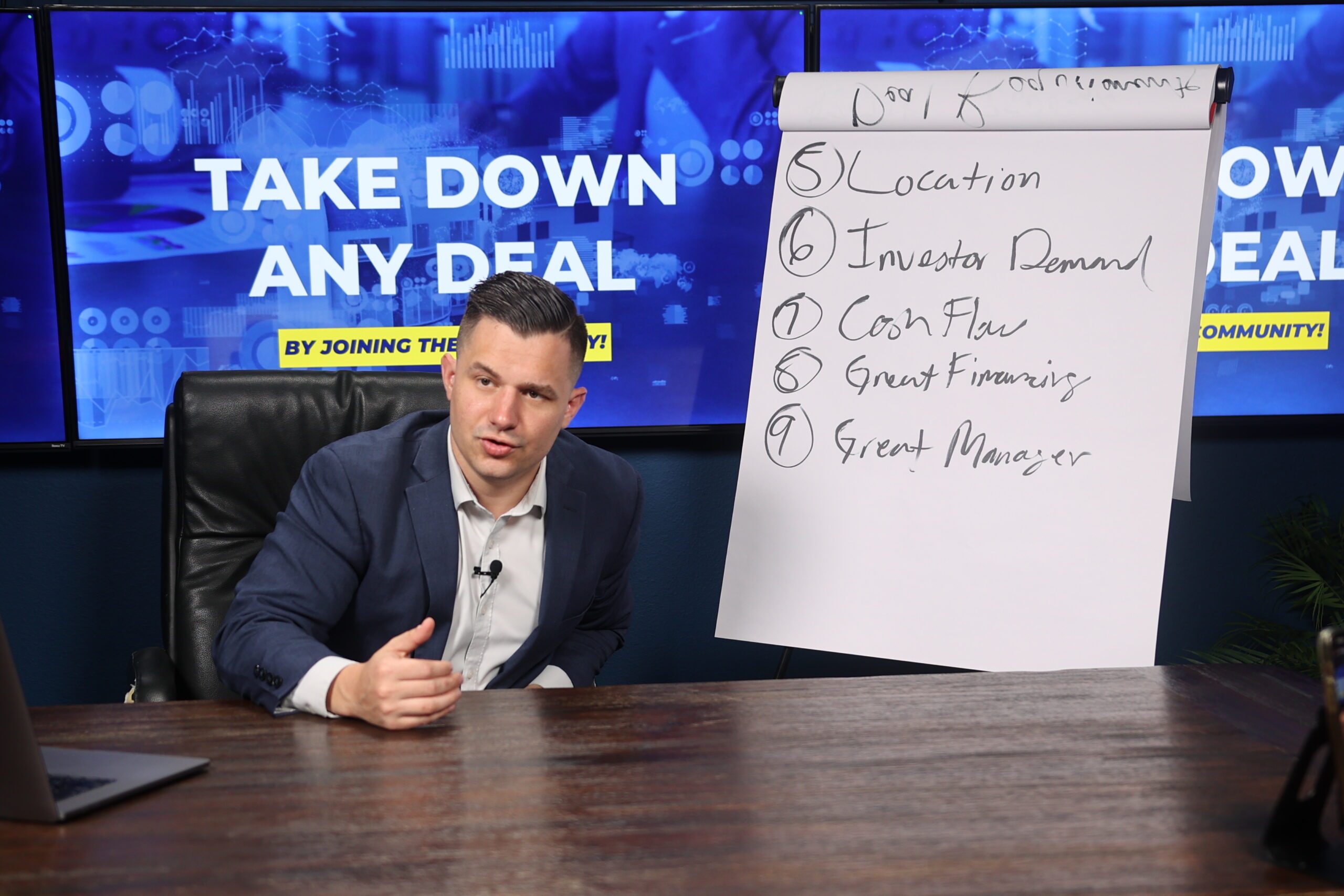

There are a variety of things that you need to keep in mind when investing in property. The list below will indicate several of the topics that will be explored in this next section of the article.

- Location of the property

- Value of the property

- Investment horizon and investment purpose

- Expected profit opportunities

- Leverage

- New construction

- And more!

To begin, we will discuss what to keep in mind when looking at a location of an investment property. The location of an investment property or any property at all is a very important factor. Most real estate investors will say that the property location is one of the most important factors when it comes to turning a profit in real estate.

Location of the property a person is investing in holds status depending on where it is. If a property has proximity to different types of amenities such as parks or green spaces, views, public amenities, and neighborhood areas, then it has a high value as a residential property. Other aspects such as how close a property is to transportation centers, highways, warehouses, and tax-exempt areas are important when looking for commercial property to invest in.

That is why one of the first things a property investor should look at is what they are planning on selling the property as. If they are planning to sell the property as a residential property, they should look for areas where there are factors to encourage residential purchasing. If they are looking for commercial property, they should look for factors that encourage commercial property.

When looking at the location of her property, it is very important to consider the long-term view and expectations regarding how the property is projected to evolve over the investment time. An example is a peaceful property with open land that diminishes in value over the years as a factory is built on the open land. That would lower the property value and diminish the profit that an investor would turn.

One of the best ways to find out how the area around the property may change over the years is to communicate with the town hall or other public groups that are in charge of urban planning. This will allow you to gain information about how the area around the property we are looking at buying will change over time, making your property more or less valuable.

The value of a property is important when it comes to financing the purchase. It also plays a factor in the listing price, the insurance, and the investment analysis. This is all dependent on the real estate valuation of the property.

One of the methods that can be used when valuing a property is sales comparisons where recent and comparable sales of properties with similar qualities are compared to create an accurate valuation of the property.

Another way to get an accurate property valuation is the cost approach, where the cost of land and construction are added together and then depreciation is subtracted. This is often done for properties that will have new construction built on them after or during the investment purchase.

Lastly is the income approach. This is when the property is evaluated based on the expected cash it will make, which makes it popular for investment properties with rentals.

Looking at the investment horizon and investment purposes is another important part of buying property for investment. The real estate market has a high value in investment with low liquidity so not having a clear or indicated purpose of the investment can lead to less than stellar profits or poor results. It can put a person into financial disarray if the investment is mortgaged and it does not have a clear use or purpose.

Once you identify what category of investment property fits your needs, you can plan how you will turn a profit from this property. One of the options for investment property is buying and self-use, which will save you on rent and give you the benefits of self–utilization along with getting a value appreciation.

Another method is buying the property and then releasing it, which offers steady and regular income as well as a long-term value appreciation. However, this comes along with the added responsibilities of being a landlord, which sometimes include legal issues, repair work, managing tenants, and other issues.

There are the options of buying and selling. There is short-term buying which is suitable for medium to small profits, typically when the property is midway through construction and then sold for profit when the construction is completed. Long-term buying and selling are focused on the larger value and appreciation that a property can gather over a long time. This one is more suitable for longer-term goals such as saving for retirement or college.

Should You Be Investing In Land Or Homes?: Is One Better Than The Other?

What it boils down to, is that neither is better than the other one. Investing in land and investing in homes serve different purposes, so they cannot be compared equally. Investing in land gives a person an opportunity to create something new, to design and build a new type of home or buildings that can make some money. Investing in homes allows a person to buy and sell property that is already built and curated.

Comparing investing in land and in homes is like comparing apples and oranges. They are similar yet they are not the same. Many people believe that investing in homes is an easier and quicker type of property investment, mainly because most often there are no large construction projects that need to take place.

Investing in land is generally considered to be a bit more of a long-term project, one that needs care and attention to the construction and other aspects of turning a plot of land into a space suitable for residential living or commercial events.

Real Estate Agent Experts That Can Help With Your Land/Home Investing Needs

When looking to invest in land or homes, you must have a real estate agent who can help you through the process. The real estate market is a highly competitive aggressive industry where it can be hard to pinpoint where good properties are.

Another important reason is to have a real estate agent in to make sure that you were going about investing in the property safely and legally. If you are investing in property by yourself, you run the risk of messing with things you do not understand. This can cause you to lose money on property investment or by the property under pretenses.

By working through this process with a professional real estate agent, you avoid any sketchiness and have someone in your corner helping you find the exact type of property that you want. This helps your search become much less intense and takes away a lot of the burden and stress associated with purchasing an investment property.

Finding a good real estate agent can be done by doing research online, acting around your social network to see if anyone recommends anyone, or by relying on a trusted real estate agency to allow you to work with one of their real estate agents. Happy house hunting and good luck in your property investment journey!